Pyth Partners with MakerDAO To Bring DAI to Solana

We are delighted to announce that the Pyth network now supports the leading decentralized stablecoin DAI in the newest DAI/USD price feed. In partnership with MakerDAO, the Pyth DAI/USD feed enables anyone to borrow, lend, or trade on the leading decentralized stablecoin on any non-EVM chain including Solana. We look forward to working with leading Solana applications such as Solend, Mango Markets, Bonfida, Drift Protocol, Jet Protocol, and PsyOptions in unlocking the next generation of DeFi services through the world’s leading stablecoin.

Niklas Kunkel, Oracle Core Unit Facilitator at MakerDAO, said: “As applications and usability of DeFi continues to grow, oracles become increasingly important to provide reliable information at a pace in line with this steady growth. As partnerships such as this become more common, the bridge between off-chain data and DeFi protocols strengthens, delivering a new era of finance. Partnering with Pyth facilitates the use of this bridge, bringing the longest standing stablecoin to the real world of finance. Having launched as recently as 2021, Pyth’s explosive introduction in the space emphasizes DeFi’s expansive growth and the need for an accessible, usable oracle.”

Michael Cahill, Director at Pyth Data Association, said: “As the Pyth community of publishers and consumers continues to grow, our oracle will continually grant more accurate and widespread price feeds to fuel growth across the DeFi ecosystem. Finance is changing, and this is clearly evident with the popularity of MakerDAO’s DAI stablecoin. We are very excited to see how our user base interacts with the new price feeds, and are equally excited about the overall industry impact of initiatives where the real world of traditional finance is transformed by the use of DeFi and oracles.”

MakerDAO and DAI

MakerDAO is a decentralized organization dedicated to bringing stability to the cryptocurrency economy. The Maker Protocol employs a two-token system. The first token, DAI, is an over-collateralized stablecoin that offers stability. The MakerDAO community believes that a decentralized stablecoin is required to have any business or individual realize the advantages of digital money. The second token, MKR, is a governance token used by stakeholders to maintain the system and manage DAI. MKR token holders are the decision-makers of the Maker Protocol, supported by the larger public community and various other external parties. Maker is unlocking the power of decentralized finance for everyone by creating an inclusive platform for economic empowerment, enabling everyone with equal access to the global financial marketplace.

Introduced in 2019, there is now close to $7B DAI in circulation, making it the number one decentralized stablecoin, with approximately $10B in value locked in the Maker protocol. More recently, MakerDAO focused on onboarding real-world assets (RWA) in order to diversify the protocol collateral basket, lowering overall risk and providing new revenue to the protocol. July 7, 2022 marked the release of the 7th RWA Vault, created for Huntingdon Valley Bank, with a $100 million DAI debt ceiling.

DAI for Solana DeFi

As of today, Solana DeFi has been mostly relying on centralized stablecoins: USDC issued from Circle and USDT from Tether — close to 99% of stablecoins on Solana are from either two previously mentioned. While convenient for users, using centralized stablecoins carry risks such as unilateral censorship or trust assumptions (e.g., that all issued stablecoins are backed off-chain by an equivalent amount of collateral).

In partnership with Maker Growth and some of the key Solana dApps, we are proud to lay the bricks towards a more decentralized future (on Solana).

Solend is an algorithmic, decentralized protocol for lending and borrowing built on Solana. Solend is the most popular lending and borrowing protocol on Solana with over $275M in TVL.

Solend will add DAI to the Stablecoin Pool so that users may either borrow or lend DAI with USDC, USDT, and many other Solana leading stablecoins: USDH, UXD, USH, and more!

You can also now create permissionless pools on Solend. Users, for example, can borrow or lend DAI against a specific (sub)set of assets! You can join the Solend Discord to learn more.

“We’re excited to bring DAI to the Solana ecosystem, which will benefit greatly from a solid decentralized stablecoin. The future is multi-chain, so we’re keen to support projects bridging from other ecosystems to Solana.” — Rooter

Mango Markets provides a single venue to lend, borrow, swap, and leverage-trade crypto assets through a powerful risk engine. Since its inception, Mango Markets processed a total trading volume exceeding $12B with over $100M in current value locked. Mango Markets is now governed by MNGO token holders via the Mango DAO.

On par with the release of the Pyth DAI/USD price feed, developers of the Mango community expressed interest in integrating DAI into the platform. The upcoming release of Mango V4 will support a wide range of additional tokens, including DAI. DAI will be available for borrowing and lending on the platform, as well as swaps.

Jet Protocol is a decentralized and permissionless borrowing and lending protocol built on top of the Solana blockchain. After launching in the 2021 fall, Jet continued upward with a vision for a better, fairer, and more innovative blockchain-based borrowing and lending with Jet V2 Beta. Meanwhile, the Jet DAO has been in charge of the platform development and more specifically onboarding new assets to the platform by following a thorough asset reviewing (community-led) process.

You can join the Jet governance forum to discuss the proposal of adding DAI to the Jet platform.

“As a former Maker smart contract engineer that’s now developing full-time on Solana, it’s rewarding to see Dai price fees going cross-chain with Pyth, and we’re looking forward to making use of the oracle in our future products!” — Wil Barnes

Bonfida is one of the earliest builders on Solana, as well as one of many firsts for the ecosystem. Their most successful product to date is their Solana Name Service. It enables the creation of a human-readable identity or address instead of the automatically generated wallet addresses. Human unreadable addresses like FsJ3A…2epH can now be expressed as “pyth.sol”.

As of today, Bonfida Solana Name Service already allows users to purchase .sol domains with 9 different assets, including USDC, SRM, SOL, or FIDA. Pyth price feeds are used to ensure fair pricing for users paying in crypto. In this spirit, we are excited to see Bonfida adding support for DAI to their Solana Name Service payments rail.

“The Solana Name Service is supposed to make Web3 easy. As such, making our service accessible to everyone and no one is key, whether that be through a variety of payment methods. Made possible by Pyth.” — bonfida.sol

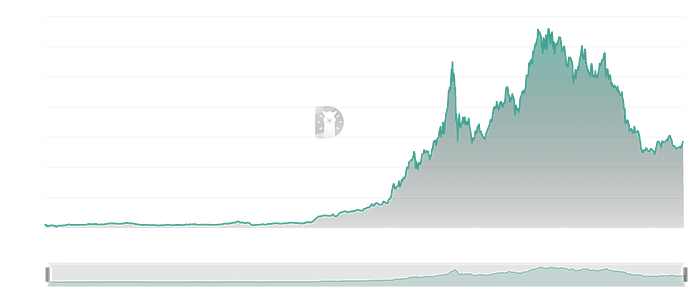

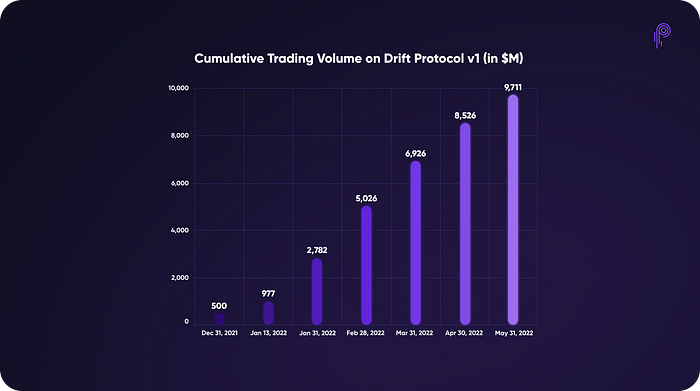

Drift is building a full-suite DeFi trading experience with spot swaps, derivatives (perpetual futures), borrowing/lending, and LP under one umbrella. Initially launched in November 2021, Drift v1 saw rapid success with more than 15,000 cumulative users and close to $10 billion in trading volume in less than 6 months. Since then, the Drift team has been working on a v2 that will provide deeper liquidity for traders, a smarter market maker as well as greater protocol collateralization.

The Pyth price feeds have enabled Drift (v1. and soon v2) to offer a wide variety of crypto assets derivatives to users, and the newly added DAI price feed will further empower the protocol to support the number one decentralized stablecoin for trading, borrowing, and lending.

PsyOptions aims to bring a TradFi feel to DeFi by building a decentralized, permissionless, and community-owned financial services platform focused on options. The PSY Ecosystem is comprised of three different products: PsyOptions, PsyFinance, and Fusion.

PsyOptions is the options protocol enabling users to trade permissionlessly various types of options (American Style Options, Tokenized European Style Options, and Under-Collateralized European Style Options) for any assets.

PsyFinance is a suite of option strategy vaults aimed at generating sustainable yield for single token assets for our users. The goal is to create the best non-inflationary yields on the Solana Ecosystem.

Fusion enables protocols to airdrop call options instead of tokens, giving you a source of revenue, discouraging farmers, and giving your community more flexibility for how they can contribute.

With the Pyth network now supporting DAI, it opens the door for DAI-denominated options as well as PsyFinance vaults where users may leverage their idle DAI to generate further returns.

What’s next?

The Pyth DAI/USD price feed is a critical step towards enabling new ERC-20 token use cases in the Solana ecosystem. With Pyth data going cross-chain thanks to Wormhole, developers on any blockchain are now empowered through Pyth and the DAI stablecoin.

What does this mean in practice? Anyone can permissionlessly deploy Pyth contracts on any chain and start requesting streaming updates through Wormhole for DAI/USD or any pair or cross-pair from Pyth’s wide offerings across crypto, FX, equities, and commodities.

The developers among you will want to check out xHack by Wormhole: this month-long hackathon is the first of its kind, with builders from 15 different blockchains coming together to hack away. The most innovative xChain application using Pyth data will be eligible to receive the $10K Pyth xBounty. More details are available here.

Resources

We can’t wait to hear what you think! You can join the Pyth Discord and Telegram, follow us on Twitter, and be the first to hear about what’s new in the Pyth ecosystem through our newsletter. You can also learn more about Pyth here.